소액결제 현금화

LGU+, KT, SKT 소액결제 현금화 루트 알아보기

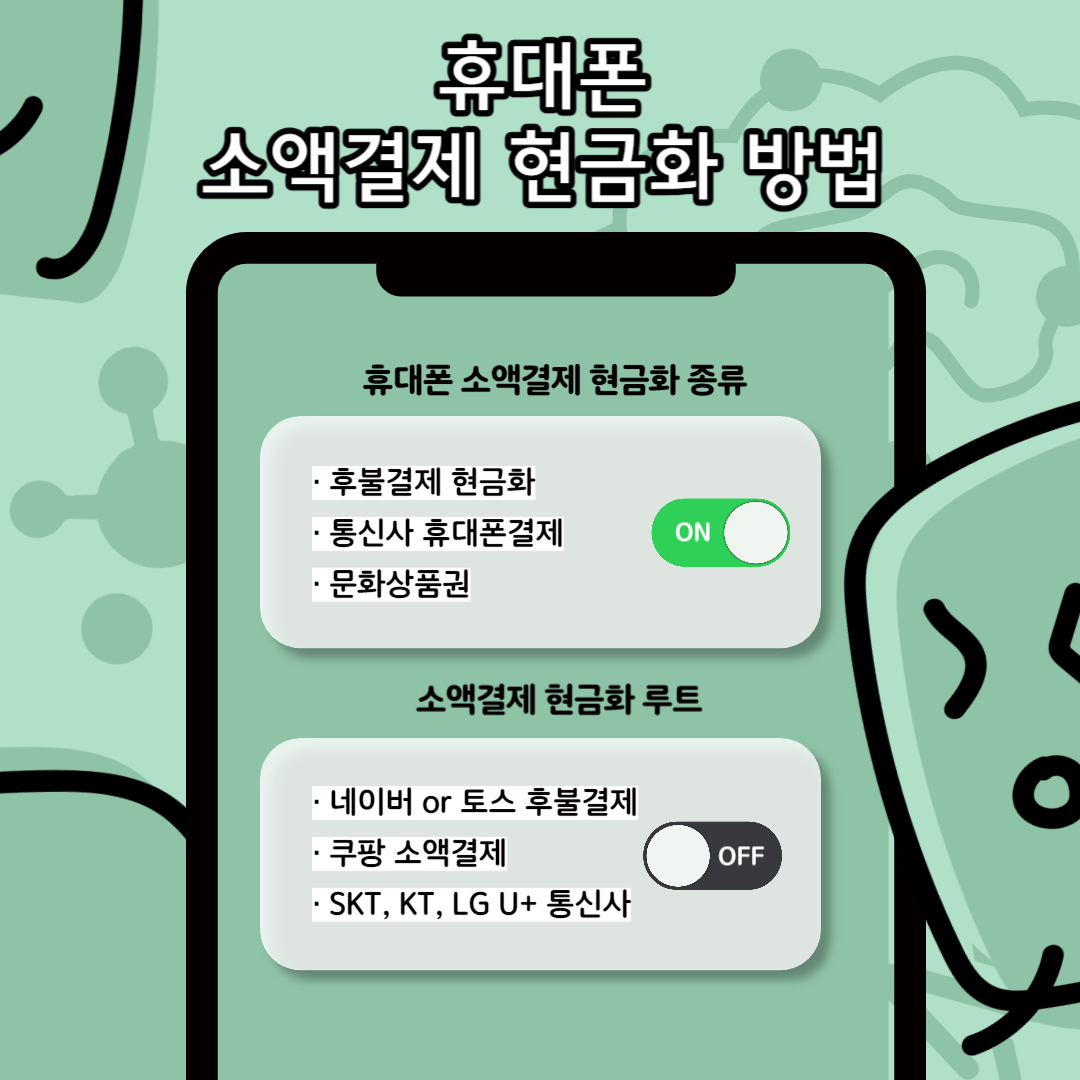

휴대폰 소액결제 현금화 루트

휴대폰 소액결제 현금화 루트는 ① 본인 명의 체크카드 또는 신용카드 계좌와 통신사 결제 서비스를 연동하는 방법 ② 결제 시 페이코, 네이버 페이, 카카오 페이 등 결제대행사 서비스 이용 등 크게 두가지 방법이 있습니다. 요금 납부 및 연체 이력에 이상이 없는 한 skt, kt, lgu+ 소액 결제 한도 내 자유롭게 사용할 수 있습니다.

휴대폰 결제 현금화 방법

휴대폰 결제 현금화 방법에는 다양한 종류가 있습니다. 후불결제 현금화, 통신사 소액결제 및 콘텐츠이용료 한도 사용, 문화상품권(컬쳐랜드, 해피머니 등)이 대표적입니다. 소액결제 업체마다 수수료, 한도 등이 다르기 때문에 자세하게 알아보신 후 사용해야 합니다.

상테크 정보

- All Post

- Uncategorized

- 상품권

- 재테크

- 통신사 소액결제

- 후불결제

- Back

- SKT

- LG U+

- KT

- 아이폰(애플)

토스 후불결제 서비스란 간편 송금 업체 TOSS 앱을 통해 후불결제를 신청 후 한달에 30만원 이내까지 먼저 결제할 수 있는 신용카드…

휴대폰 소액결제 현금화는 2단계를 거쳐 콘텐츠 구매 및 현금화가 가능합니다. 첫째, 개통한 핸드폰을 가지고 해당 통신사의 휴대폰 결제 서비스 사용이…

티머니 현금화 방법과 환불 신청 방법에 대해서 알아보겠습니다. 티머니는 최초 전국에서 호환이 가능한 교통카드로 대한민국 교통카드의 상징이라고 볼 수 있습니다.…

상품권 현금화 방법

문화상품권 소액결제는 컬쳐랜드, 해피머니, 구글 기프트카드 등 상품권 구매 시 사용할 수 있는 고유 번호를 각각 해당 앱에 등록하여 현금처럼 사용하는 결제 방법입니다. 상품권 금액 내에서 사용할 수 있으며, 잔액은 자유롭게 사용하거나 부족한 금액은 충전해서 사용할 수 있습니다.

컬쳐랜드

국내 모바일 문상 판매량 1위

해피머니

컬쳐랜드 추격 업체

Google Gift Card

구글 Play 인앱 전용 기프트카드

북앤라이프

도서문화상품권 전문 업체

소액결제 미납정책

소액결제 미납정책 루트

skt, lgu+, kt 통신사 별로 소액결제 한도가 있습니다. 한도 및 연체 미납 정책으로 인한 문제 발생 시 우회 루트를 안내해드리고 있습니다. 편하게 문의주세요.

휴대폰결제 현금화

휴대폰으로 다양한 문화상품권, 후불결제 서비스를 사용해서 결제 금액을 현금으로 바꿀 수 있습니다. 단, 현금화 시 일부 수수료가 발생할 수 있습니다.

정보이용료 현금화

통신사의 정보이용료, 콘텐츠 이용료를 활용해서 월 최대 100만원 한도 이내 결제가 가능합니다. 정보이용료 결제를 통해서 수수료 일부를 제외하고 3분 이내로 해당 금액을 현금으로 받을 수 있습니다.

FAQ

'소액결제현금화'란 문화상품권, KT, SK, LG U+ 통신사, 구글 플레이 스토어, 원 스토어, 리니지 모바일 등의 콘텐츠 이용료 결제를 활용하여 현금을 받는 것을 의미합니다. 업체 수수료를 제외한 나머지를 현금으로 받을 수 있기 때문에 현금이 필요할 때 유용하게 쓰일 수 있습니다. 주로 기존에 백화점, 문화 상품권 등을 교환해주는 정식 등록 업체들이 휴대폰 소액 결제까지 함께 진행하고 있습니다.

소액결제 현금화 방법은 통신사 휴대폰결제 한도 또는 핀테크 회사의 후불결제 서비스 등을 이용하는 방법이 있습니다. 우선, 혼자 통신사를 이용하는 방법과 모바일 상품권을 이용하는 방법, 구글 기프트 카드, 원스토어 앱 등을 이용하여 콘텐츠 이용료를 별도 결제 후 현금으로 바꾸는 방법들이 가장 많이 사용하는 방법으로 자세한 방법은 블로그 또는 문의를 통해 확인하실 수 있습니다.

일반적으로 휴대폰을 이용한 소액결제 현금화의 경우 수수료가 10% 정도 됩니다. 상품권의 경우에도 업체마다 차이가 있지만 5~10% 내외의 수수료가 발생합니다. 정보이용료의 경우에는 앱 수수료에 대한 추가 비용이 따로 발생하기 때문에 현금화 시 소액결제 현금화보다는 다소 수령할 수 있는 금액이 작아집니다. 본인의 상황과 금액에 맞게 현금화 방법을 선택해서 진행하는 것을 권장드립니다.

소액결제 현금화는 당장 현금이 필요한 경우가 발생할 때 사용하면 용이한 방법입니다. 휴대폰을 통해서 통신사 소액결제 한도 내에 결제 후 티켓 업체를 통한 현금화를 진행할 수 있기 때문입니다. 다만, 익월 휴대폰 요금에 포함되어 나오기 때문에 해당 금액을 지불할 수 있는 상황에 사용해야 안전합니다. 연체가 발생하는 경우 신용 하락에 영향을 미칠 수 있기 때문입니다.

문화상품권(컬쳐랜드, 해피머니, 북앤라이프, Google Gift 카드 등) 충전을 통해 수수료 지 불 후 남은 금액을 현금으로 받을 수 있습니다. 백화점 상품권 현금화 방법과 똑같으며 합법적인 방법으로 많은 분들이 이미 사용하고 있습니다.

정보이용료

콘텐츠이용료 현금화

모바일 소액 결제 서비스를 이용하여 정보이용료, 콘텐츠 이용료를 지불하고 게임 아이템 구매 또는 캐쉬 충전 등을 사용할 수 있습니다.